work from home equipment tax deduction

You dont have to be a homeowner to claim the deduction apartments are eligible as are mobile homes boats or other similar properties according to the IRS. The rule of thumb is that if youre a W-2 employee youre not eligible for a work-from-home tax deduction.

Employees Working From Home What Tax Deductions Can You Claim Recro

This has been in place since 2018 when the.

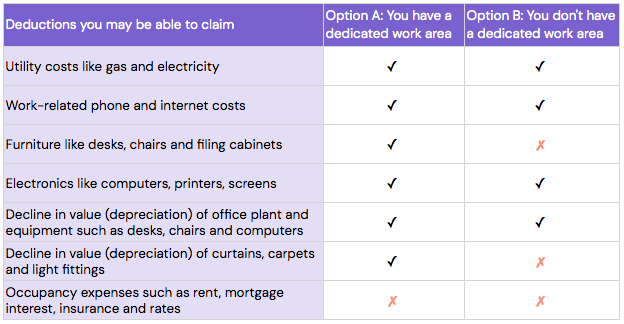

. If you have a space in your home in which you work on a regular basis then you may be able to claim a home office deduction. Deductions for Employees Working From Home. The Tax Credit and Jobs Act which took effect in 2018 eliminated that deduction for workers who receive a W-2 from their employer.

Council and water rates 4259. Total occupancy expenses floor. For example a company that purchases a new printer for 500 has the option of either.

Did you know that roughly 26 of Americans worked from home during. There are two methods for claiming the deduction. What are the requirements for claiming home office expenses.

The home office deduction allows certain people who use part of their home for work to deduct some housing expenses. A Deduction for a Home Office. The Tax Cuts and Jobs Act of.

Section 179 caps deductions at one million dollars and spending on equipment purchases at 25 million. If your employee is a resident of a state with whom Illinois does not have a reciprocal agreement ie Missouri you must withhold Illinois income tax on all income that is. This method allows you to take a deduction of 5 per square foot used for work up to a maximum of 300 square feet.

This wasnt always the case though. The expense must directly relate to earning your income. An employer may make certain deductions from your pay but the law mandates that each employee shall be furnished with an itemized statement of deductions for each pay period.

Employees working from home cant take the home office deduction even if youve been asked to work from home due to COVID-19. The IRS used to allow W-2 employees to deduct expenses related to working from home but Congress changed that with its 2017 tax reform bill. For the home office deduction measure the approximate square footage of your office compared to the rest of your home.

Unless you have a permanent place of work to which you must commute all miles driven between your home and a customer are tax deductible. Mileage you can deduct. Rus Garofalo president and founder of the Brooklyn NY-based taxed prep company Brass Taxes says it depends on which state you live in.

You must have spent the money. Tax deductions for expenses needed to work from home are. Abdul calculates his deduction for occupancy expenses as follows.

If you have to buy new office equipment to effectively work from home you may be able to claim these costs on your tax return. Before the Tax Cuts and. Apr 14 2022.

Tax deduction for home office expenses is only allowed if the room is regularly and exclusively used for the. A few very specific types of W-2. Additionally with the simplified.

With the simplified method taxpayers receive a deduction of 5 per square foot used for home business with a maximum of 300 square feet. The federal tax code allows individuals and businesses to make noncash contributions to qualifying charities and to claim deductions for. Taxes Remote Working.

This can include items like. As an employee to claim a deduction for working from home all the following must apply. Tax Information on Donated Property.

This is the percentage of your rent or mortgage and.

Your Guide To Home Office Tax Deductions Tax Accountant Bottom Line Control

Working From Home Tax Deduction Prerequisites And Tips Ionos

The Top 5 Forgotten Tax Deductions Don T Miss These On Your Return

:max_bytes(150000):strip_icc()/personal-finance-work-from-home-guide_round1_grey-dfcbdfa007674b3bb6a568c8cf42b849.png)

The Ultimate Guide To Working From Home

Work From Home Here Are The Tax Deductions That You Re Missing Mcleod Associates

What If I Incur Expenses In Relation To My Job Low Incomes Tax Reform Group

2022 Work From Home Tax Deductions Smartasset

You Probably Can T Write Off Your Home Office On Your Taxes

Working From Home You Must Keep Records Canberra Citynews

Taxes You Can Write Off When You Work From Home Infographic Bookkeeping Business Business Tax Business Tax Deductions

The Tax Rules For Home Businesses And Working From Home

Sole Trader Tax Deductions How To Optimise Your Taxes In 2022

Work From Home Tax Deductions You Can Claim This Year Abc Everyday

Tax Deductions For Freelancers And Self Employed People Expert Advice Apartment Therapy

How To Claim Working From Home Deductions Kearney Group

Working From Home Tax Deductions Covid

Section 179 Tax Deduction For 2022 Section179 Org

Computer As A Tax Deduction Can You Claim This On Your Return

Tax Deductions When Working From Home Everything To Know Fox Business